B2B decision-makers are increasingly more averse to cold outreach. We augment traditional outbound strategies (cold calls/emails, conferences, PR) with engaging and informative science-focused marketing content that spans the buyer’s journey—so your audience finds you, trusts you, and proactively seeks your offering.

Our collaboration begins with an internal kickoff meeting and client questionnaire to thoroughly access your organization’s track record, unique value proposition, target audience, competitive landscape, and marketing goals.

Following approval of the initial direction, we delve into market research and map out an integrated tactical marketing strategy. Our comprehensive research involves stakeholder interviews, market analysis, and competitive landscape assessment.

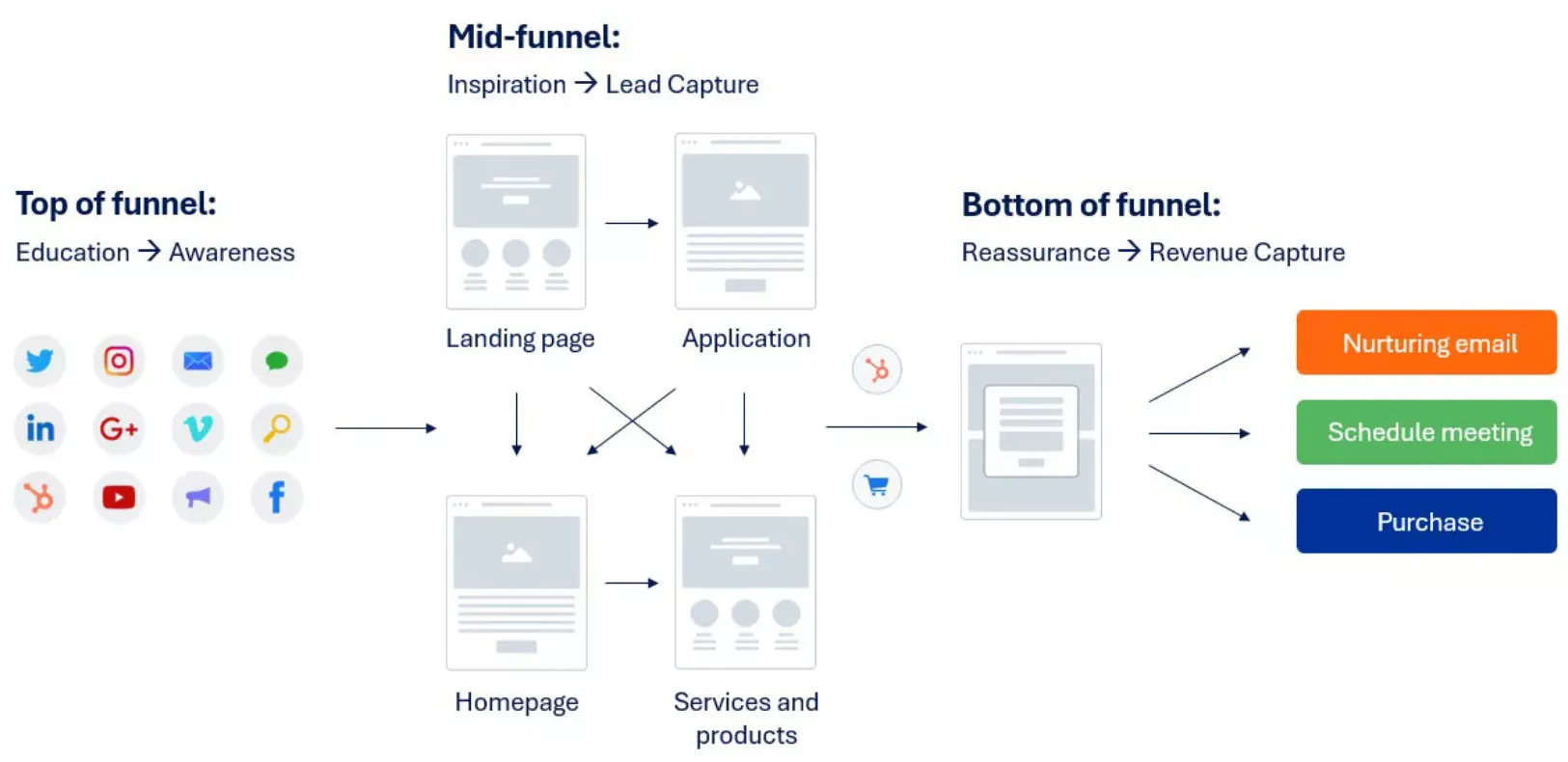

We use our analysis to build a consistent, powerful brand story optimized to educate, inspire, build trust, and facilitate purchasing decisions. From there, we create detailed roadmaps for executing strategies across various platforms, including your website, email campaigns, paid ads, event attendance, and more.

Campaigns employing multiple channels convey your unique messaging in a way that is believable, and compelling to your audiences. As scientists, we continuously monitor the data and make regular adjustments to optimize results.

Unlike general marketing agencies, our team includes PhD level scientists as well as senior-level experts in graphic design, web development, and digital marketing. This unique combination allows us to:

Market research helps you understand scientific demand, competitor positioning, and the needs of researchers and buyers. With clearer insights, biotech companies can make informed decisions about product messaging, go-to-market strategy, and resource allocation.

We deliver competitive analyses, customer interviews, product positioning studies, landscape assessments, and persona development tailored to scientific audiences. These insights help you refine your strategy and align your brand with real market needs.

We combine qualitative and quantitative insights with industry experience to identify growth opportunities and messaging priorities. This ensures that your strategy speaks clearly to researchers, clinicians, and decision-makers.

Most research and strategy engagements take 4–8 weeks depending on scope, audience size, and the number of interviews or analyses required. We move quickly but allow enough time for accurate insight gathering and interpretation.

When you understand scientific motivations and pain points, your content, campaigns, and sales conversations become more focused and effective. This leads to better engagement, higher-quality leads, and stronger pipeline growth.